trust capital gains tax rate uk

If the settlor dies after 16 March 1998 and the trust is UK resident the gain will be assessable on trust. If this amount places you within the basic-rate tax band you will pay 10 tax on any capital gains.

Difference Between Income Tax And Capital Gains Tax Difference Between

From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets.

. Capital gains tax rate. The trustees of a UK-resident trust may be liable to pay UK capital gains tax CGT on the trusts worldwide assets. If a vulnerable beneficiary claim is made the trustees are taxed on.

Grandparents set up a Trust for their grandchild. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. Dividend tax rate up to 1000 per annum 75.

They contribute 312500 cash into the Trust and it is invested into a property producing rental income of 12500 a year a 4. An overview of the capital gains tax treatment of UK resident trusts set up by UK individuals. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

It was well attended and several questions were raised that we did not have time to. The tax-free allowance for trusts is. In 2021 to 2022 the trust has gains of 7000 and no losses.

In the UK Capital Gains Tax for residential property is charged at the rate of 28 where the total taxable gains and income are above the income tax basic rate band. 875 on income in standard rate band 3935 dividend trust rate on income over standard rate band 0 875 3375 3935 Capital Gains Tax CGT Person liable for CGT on capital. The trust will benefit from the 1000 standard rate band taxed at 20.

If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. The taxable capital gain of a trust other than a special trust is taxed at an effective rate of 36 while that of an individual is taxed at a maximum effective rate of 18. Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022.

The following Capital Gains Tax rates apply. Interest in possession trusts are subject to tax at the basic rate. This note outlines how capital gains tax applies to trusts including special rules for trusts in which.

The rules for CGT for non-UK resident trusts are complicated. The ICAEW Tax Faculty presented a webinar on the tax treatment of UK trusts on 10 November 2016. 20 28 for residential property.

AEA is the tax-free allowance. For example if your. After you work out if you need to pay Capital Gains Tax is due if the total taxable gain is more than the Annual Exempt Amount eg.

Income Tax and Capital Gains Tax. For higher-rate and additional-rate you will pay 20. Inheritance tax transfers into discretionary trusts 20.

Add this to your taxable. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. First deduct the Capital Gains tax-free allowance from your taxable gain.

10 and 20 tax rates for individuals not including residential property and carried interest. 18 and 28 tax rates for individuals. Capital gains tax rates for 2022-23 and 2021-22.

20 on rental profits and interest and 75 on dividends. 2022 Long-Term Capital Gains Trust Tax Rates.

How To Tax Capital Without Hurting Investment The Economist

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax 30 Day Rule Bed And Breakfast

Capital Gains Tax Examples Low Incomes Tax Reform Group

What Is Investment Income Definition Types And Tax Treatments

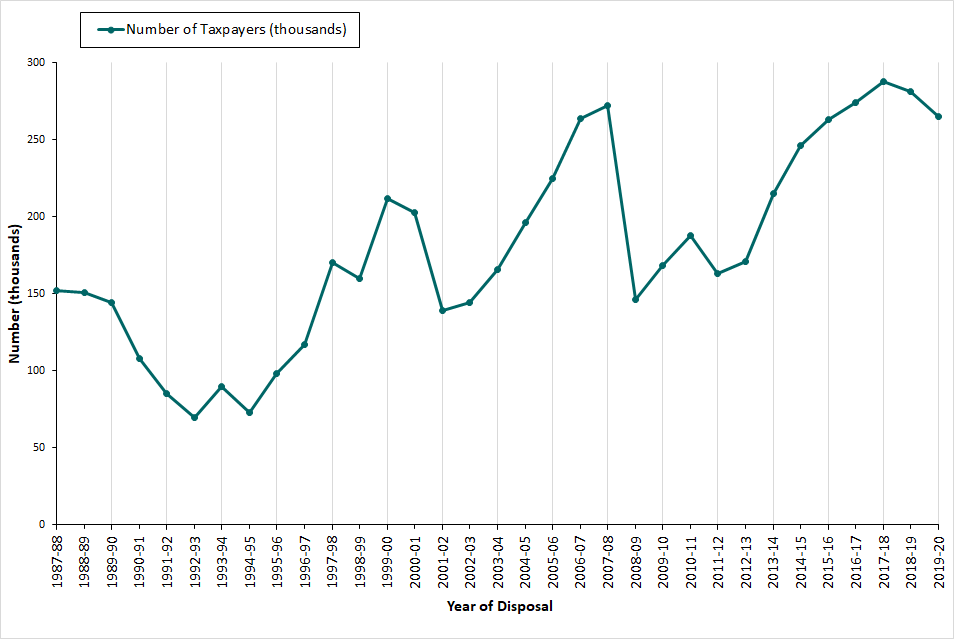

Capital Gains Tax Commentary Gov Uk

Capital Gains Tax Commentary Gov Uk

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Types Exemption And Savings Forbes Advisor India

Capital Gains Tax For Expats Expert Expat Advice

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Difference Between Income Tax And Capital Gains Tax Difference Between

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group